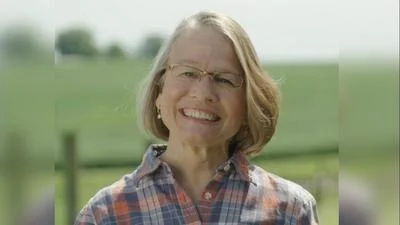

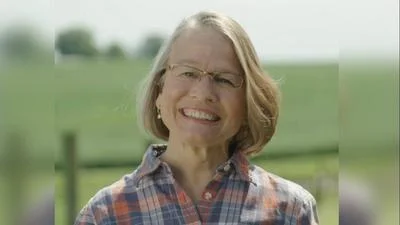

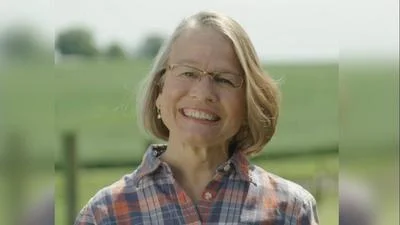

Rep. Mariannette Miller-Meeks, U.S. Representative for Iowa's 1st District | Official U.S. House headshot

Rep. Mariannette Miller-Meeks, U.S. Representative for Iowa's 1st District | Official U.S. House headshot

U.S. Representatives Mariannette Miller-Meeks and Sharice Davids have introduced a bill aimed at extending the Second-Generation Biofuel Producer Tax Credit. This legislation seeks to support biofuels production both in the Midwest and nationwide.

“Iowa’s biofuels production fuels the country and powers our economy,” stated Rep. Miller-Meeks. She emphasized the need for market certainty to maintain affordable, low-emission energy production. Expressing gratitude for Rep. Davids' collaboration, she described the bill as a bipartisan effort that could reduce energy costs and boost biofuel production in the Midwest.

Rep. Sharice Davids added her perspective on federal incentives, saying, "Federal incentives for biofuels are only good enough if our farmers and producers have certainty." She highlighted her ongoing efforts to encourage the Biden administration to finalize new rules for biofuel producers, stressing her commitment to ensuring stability in the biofuels market while keeping costs low for Kansans.

Geoff Cooper, President and CEO of Renewable Fuels Association, expressed concerns over delays from the Treasury Department regarding guidance on a new tax credit set to begin soon. He noted that “cellulosic biofuel producers have been anxiously awaiting guidance” about implementing this new credit system but commended Reps. Miller-Meeks and Davids for their proactive approach with this legislative extension.

The current tax credit allows certain second-generation biofuels producers registered with the IRS to claim up to $1.01 per gallon of fuel produced if they meet specific environmental standards set by the U.S. Environmental Protection Agency (EPA). This tax credit is scheduled to expire at 2024's end.

A forthcoming 45Z clean fuel production credit aims to provide technology-neutral benefits starting in 2025; however, lack of guidance from Treasury on eligibility requirements has left producers uncertain about future investments. The proposed one-year extension intends to offer a smoother transition between credits by extending current benefits until clearer guidelines are established.

Alerts Sign-up

Alerts Sign-up